It is said to be the beginning of manufacturing. The final product that a company ships out begins with a die and mould. Across industries that manufacture ‘solid’ products, it must have a die and mould. These vary based on the product, the component or sometimes even a minute part. The type of material that is used for making the mould depends upon the product that is going to be made with the mould.

More often than not, the die and mould making industry supply tools to companies from cross vertical domains such as automotive, aerospace, industrial machinery and heavy engineering, defence to consumer goods and electronics. In all the above, it is the automotive industry that is the largest source for die and moulds. Newer industries like aerospace and medical equipment are growing, but that is niche and little is spoken about that.

Ramakant Reddy, MD, LMT Tools India, says, “The major change in vehicle systems will be in the way it runs in the future. The diesel and petrol engines will be replaced in part by electric vehicles. This will reduce the need for hot forging dies for components like crankshaft, connecting rods, etc. To reduce body weight there would be more use of plastics & composites which again will have an effect on punching & pressing dies. With increased use of aluminium, plastics, and composites there will be more opportunities for injection moulding, die casting dies, etc. The die and mould manufacturers should adapt themselves to this change of requirement so that the bottom line is not affected.”

There are people in the industry who believe that since manufacturing is an ongoing process and that goods will be continued to be made, die and mould will never go out of fashion. “There will, of course, be some course correction needed with the advent of vehicular ecosystem. IC engines will soon make way for electric power trains and this will impact the die and mould sector. They should look at additive manufacturing and other components of Industry 4.0 to stay competitive,” says Dr Guruprasad Rao, director and Mentor, Imaginarium India.

The die and mould making industry in India has evolved over the years and is at par with the best of international industry names. Today, die and mould makers in India can confidently compete with the global market and over the years have recorded phenomenal all-round market growth. Moreover, some of them have also built a reputaton for offering unique dies and moulds for yet-to-be launched vehiclular models – mainly overseas.

Making a mark

Most automotive makers are also known to have their die cast and moulds made overseas. This is especially true of MNCs, especially in the automotive sector. For products that are common across vehicles, in case of gear boxes and dashboards, the dies are imported into the country. Raju Battula, national manager, technical support, DesignTech Systems, says, “There’s a need to intensify industrial output while focusing on Make in India. This also requires necessary policies related to ease of doing business in India and the government is working in that direction. If that happens, then industries like cutting tools and die and moulds should grow manifold.”

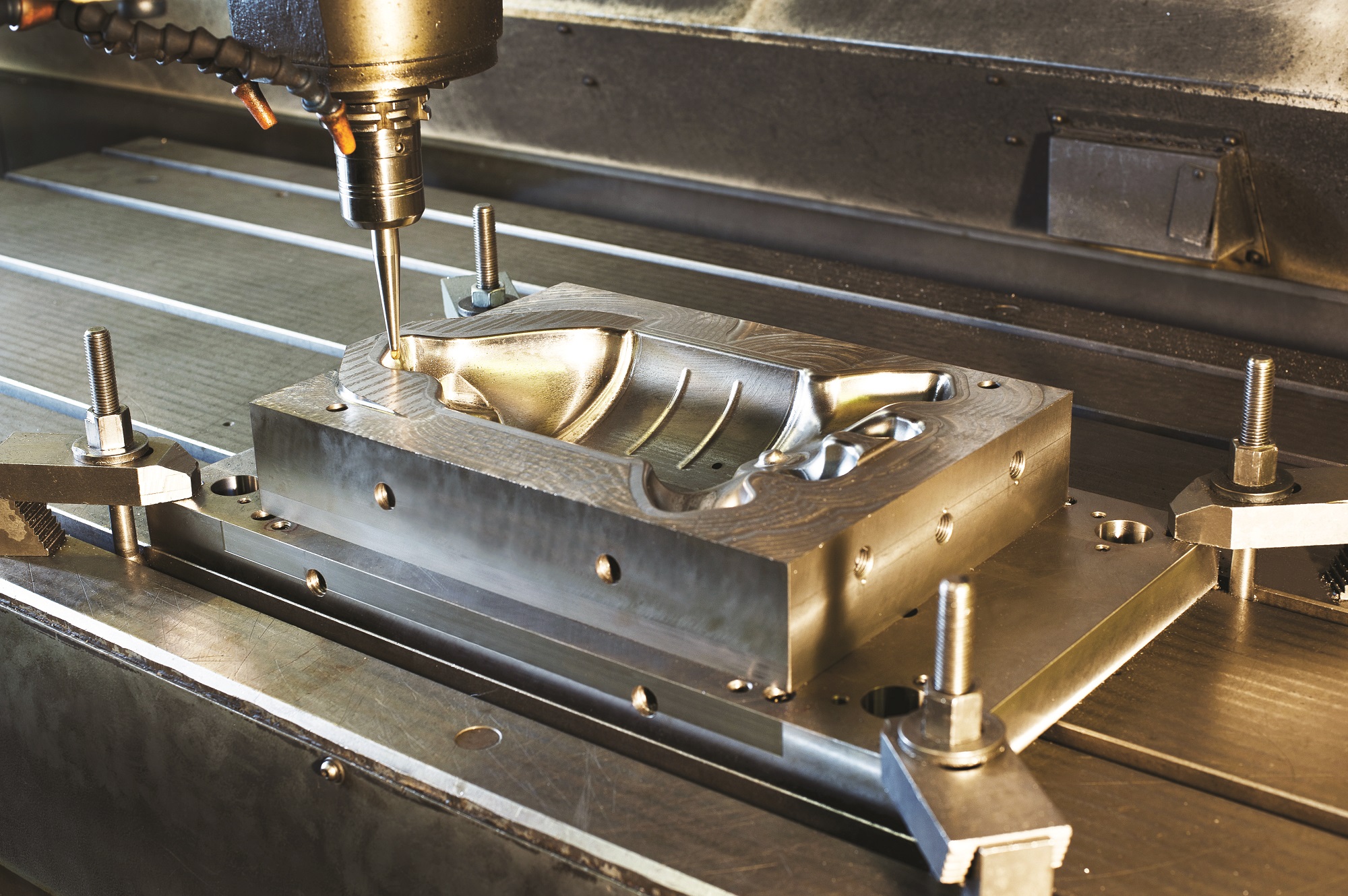

High quality standard components and high precision are the buzzwords of any die and mould business. In today’s times, the tool room industry is undergoing a change in manufacturing practices. In times of yore, only a few important components were manufactured using CNC machines; today, most of the industry has already switched over to CNC to gain a competitive edge. Reddy says, “On our part, we are constantly working on new cutting grades and coatings. This is necessary because the requirements for the dies and moulds change. More and more hardened materials are being used. Also the manufacturing of stainless materials is increasing.”

An industry spokesperson says that because of improving quality, it has seen a rise in exports, which involves superior quality standards for the international market. He says, “With this, the need for adopting better technology, components, materials and machinery to ensure high quality, has become very important for Indian businesses.”

Considering the level of globalisation within the die and mould industry, there has been much more stress on quality and this is especially true when it comes to the kind of moulds being used across industry segments. Because of this the industry too has woken up and in a short time been able to deliver (along with the demand) innovative technologies and resourceful products. Moreover, cost competitiveness through shorter run times and upgrading productivity are some of its foremost deliverables.

Over the last few years, several new technologies being have been introduced to add efficiency and effectiveness to companies’ design and manufacturing operations, but also a lot of technologies that have been around for quite some time, have evolved greatly. Battula says, “One must understand that die design, no matter how complicated with defining the right tolerances, cooling channels, and gateways, can be done with intricate precision. It would be helpful if die and mould makers took to understanding CAE solutions, FEA (finite element analysis), thermal and fluid flow analysis, Computational Fluid Dynamics (CFD) and all this can be better gauged from the point of view of virtual simulation software.”

He believes that these new age technologies such as 3D modelling software, CAE software solutions,

CAM solutions, 3D printing, will give the makers a competitive edge and help them optimise their working processes and resources, better the products quality and that too in reduced turnaround time and costs.

Advancements in technology

According to the Indian tool room manufacturing forums, the domestic average market size of die and mould industry could touch around Rs 30,000 crore by 2021 from its current average market size of Rs 18,000 crore. The proposed growth definitely demands a sustained relationship among the research forums, government bodies, trade associations and the policy makers in a right mix towards next level growth.

What has led to some kind of lethargy in the sector is the lead time and quality meeting global standards are major issues faced by the local die & mould making industry. Most of them receive little or no investments, which could be because a majority of tool makers are small and medium sized. One needs to be aggressive enough to double the capacity considering growth prospects.

In terms of newer materials and sources of revenue, Dr Rao says, “There are newer materials such as shape memory alloys, composite materials, carbon fibre based structural composites, nano-materials offering extreme properties. The need for embodied sensors into the parts will drive the smart integrated parts for Industrial Internet of things. The R&D in these are fairly developed in these areas to impact market and improve overall quality of life. The mould is a means to an end. Additive manufacturing offers to build parts directly with no need of moulds. It offers extreme agility in manufacturing. The die and mould community have to use technologies with their individual strengths and offer agile options to produce anything. So, the CNC, robotics and AM will offer hybrid fabrication solutions. The best part is their portability and enable them to be installed close to load centres.”

The autonomous vehicles, Lithium ion batteries, charging stations, Internet of Things, Artificial Intelligence, cloud computing, 5G and 6G networks are a few important innovations in this emerging use context. Die and mould will be complemented by batch 3D printing, vacuum casting, RIM and hybrid technologies.

In all this, knowledge and skill transformation is just as essential to survive. India faces a dual challenge of severe scarcity of highly-trained, quality labour, and non-employability of large sections of the educated workforce that possess little or no job skills. Upgradation is needed here at both ends. Without skilled workforce, no sector can develop or grow. One must be open to adopting the latest technologies to stay attuned to the current industry working trends.